AT&T (T) reported 2019 Q1 earnings and continued its streak of either missing or just hitting expectations. EPS was in line with expectations, while revenues were off $270M despite growing 17.8% Y/Y fueled by the Time Warner acquisition.

(Source: AT&T Investor Relations)

Given its recent track record at earnings releases, AT&T added even more drama for investors as it had already been missing EPS estimates 62% of the time and revenue estimates 75% of the time over the last two years.

Readers following my analysis know that AT&T is my largest position, and despite all the drama with the stock price, I remain very long on T.

The stock dropped almost 5% on Wednesday, however, the earnings report was not as bad as the stock price drop would suggest. In fact, it was actually anything but bad. Here’s why!

What is going on at AT&T?

Financially, the company recorded but missed Q1/2019 sales of $44.83B (up 17.8% Y/Y, but missed by $270M), with EPS of $0.86 in line with expectations. It is guiding for adjusted EPS growth in the low single digits and free cash flow in the $26B range.

Burning through the video subscriber customer base

The biggest drawback with the current earnings report was again the huge loss of video customers. AT&T lost 627,000 video customers in the most recent quarter with premium TV contributing the lion’s share of the loss (544K customers). DirecTV Now reported a subscriber loss of 83K customers following price increases and fewer promotions.

Those figures are reported in AT&T’s Entertainment Group, but despite such a large loss of subscribers, overall revenues and margins for the group show a much a different picture. The segment reported sales of $11.3B (down $100M from Q1/2018), but EBITDA increased by $200M to $2.8B, as EBITDA margin rose 1.8pp Y/Y. How is that possible?

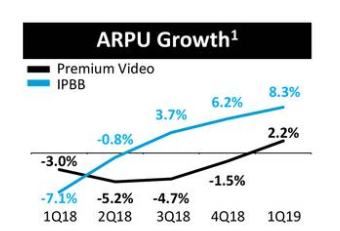

Apart from cutting down on expenses such as marketing cost and realizing cost efficiencies, AT&T has started to better monetize those customers that remain with the platform. Premium video ARPU came in at $114.98 and is up 2.2% Y/Y, and Broadband ARPU has reached $50.10 and is up 8.3% Y/Y.

Source: AT&T Earnings Call Slides 2019 Q1

As such, AT&T is exactly doing what it has been constantly reiterating during numerous calls:

That customer base that we burned off, if you will, in the third quarter (2018), and that we may or may not going forward chase in any given quarter, is always available. It’s very promotionally-sensitive and price-sensitive, so you can always go get that business when you find the economics to do it so – or advantageous as a result of, for instance, what you can do on ad-supported models. – Source: AT&T Q3 2018 Earnings Call

With less subscribers left in the pool that are much more profitable, AT&T remains confident that it can hit its goal of stabilizing EBITDA for the segment in 2019 and is eyeing “real improvement in year-over-year EBITDA results starting in the first quarter.”

And AT&T delivered as EBITDA results improved, with management becoming even more optimistic, as it now states that “we grew Entertainment Group EBITDA in the quarter and are confident we’ll meet or exceed our full-year target.”

One of the core priorities for AT&T in 2019 is to stabilize the Entertainment Group EBITDA, and with Q1 now in the bag, we have been seeing real improvements here. That improvement is currently mainly coming from broadband revenue. However, as AT&T has been burning off lots of those “low-value, high-churn customers,” those that remain in the pool are also showing growth in terms of ARPU metrics.

It remains to be seen how video subscriber losses will develop over the next quarters, but as the pool of those low-value customers has dramatically shrunk over the last two quarters, losses should decelerate over the rest of the year with Broadband helping offset these losses.

Debt and Cash Flow Situation

Another positive I take from the earnings report is the debt and cash flow situation. In this quarter, AT&T reduced net debt by $2.3B and remains on track to achieve its 2019 and deleveraging plan, which will see net debt decline to $150B and represent a net-debt-to-EBITDA ratio between 2.5x and 2.6x.

That is still a big number, but for a company that is generating over $25 billion in FCF in a year, it is certainly possible to service these debt obligations, while at the same time continue to pay juicy dividends and substantially invest into its business. For 2019, gross capital investment is expected to be in the $23 billion range, which just shows that AT&T is a cash flow monster that is able to retain more than half of its operating cash flow as free cash flow.

Over the next four years, from 2020 to 2023, the company will have to redeem almost 1/3rd (~$60 billion) of its total current debt amount, which will notably exceed free cash flow after dividends in three out of four years. Although this will slow down debt repayment, AT&T’s total debt by end of 2023 will decline further to $136.5 billion, with full-year EBITDA expected to grow to $68 billion by year end. Assuming its 2019 cash balance of $10.8 billion remains unchanged (i.e., any gaps between FCF after dividends and redeemable debt will be funded with new debt) gives us a net-debt-to-EBITDA ratio of just under 2 and, as such, represents a deleverage of more than 1/3rd from current heights and certainly demonstrates that AT&T is, in principle, more than capable of managing that debt risk.

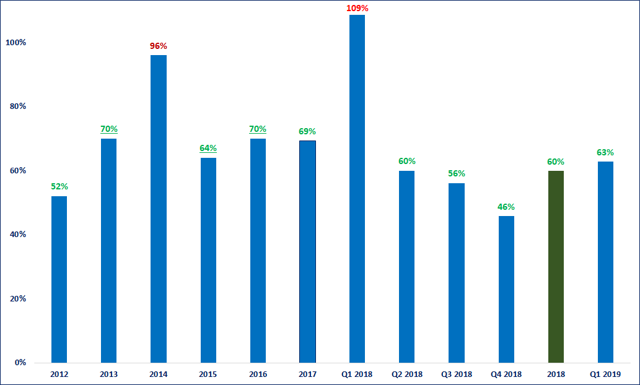

If that holds true, the company will also have no problems to maintain and grow its alarmingly high dividend. In fact, despite almost doubling its total debt with the Time Warner acquisition, it has been accretive from day 1 and thus helped AT&T not only to maintain its safe dividend payout ratio but also actually improve it. By end of 2016 and 2017, the FCF dividend payout ratio stood around 70%, while in 2018, it came in at only 60% and is expected to decline into the high-50s as 2019 unfolds. This will ensure a very high degree of dividend safety, and while the current yield reflects the current level of risk as AT&T transforms from an “old economy-like telecom” to a well-diversified, content-driven media enterprise, it does not mean that the sky-high dividend is in danger.

AT&T’s cash flow is very strong. Operating cash flow is up 24% Y/Y and TTM FCF has hit $25.4B and is thus well on track to meet full fiscal-year guidance of around $26B for 2019. The dividend is easily covered as well with a FCF dividend payout ratio of 63% for the last quarter.

This is a substantial improvement to Q1/2018, and given that the first quarter is usually the weakest, I wouldn’t be surprised if AT&T even exceeds its annual FCF guidance.

The streaming wars

Disney (NYSE:DIS) has recently fired up the waging streaming wars even more as it unveiled its highly-anticipated Disney Plus app. The brand-new service will launch in Q1/Q2 of fiscal 2020 starting at a red-hot price of $6.99/month and thus substantially undercutting the entry price for Netflix (NFLX). Disney’s stock soared by 12% and more following the announcement and a very recent survey has found that Netflix could lose as much as 15% of subscribers to Disney Plus, thanks to the aggressive pricing and Disney’s rich and exclusive content.

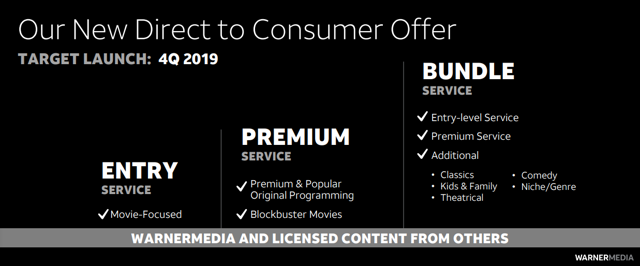

Next up it will be AT&T to unveil its precise plans for its very own streaming service, which is expected to be launched in Q4/2019.

Source: AT&T Analyst Event November 2018

As of today, we don’t know a lot apart from the fact that it will come with a three-tier pricing setup featuring Warner Media and selected licensed content. Pricing is unknown. The exact content is unknown as well. However, the recent announcement by Disney has shown how quickly such a streaming service, provided the financials and growth trajectory are appealing, can boost the stock price and investor sentiment.

However, before AT&T goes full-scale with that approach, I sure hope that it will test multiple setups and price points with different customer segments and also run tests mirroring the setup of extremely successful yet unprofitable Netflix. And don’t forget, when AT&T goes beta with its service, Disney will already go live with its own Disney+ streaming service.

It’s unlikely that even if launched at the end of this year, it will take some time for the new service to gain momentum.

Investor Takeaway

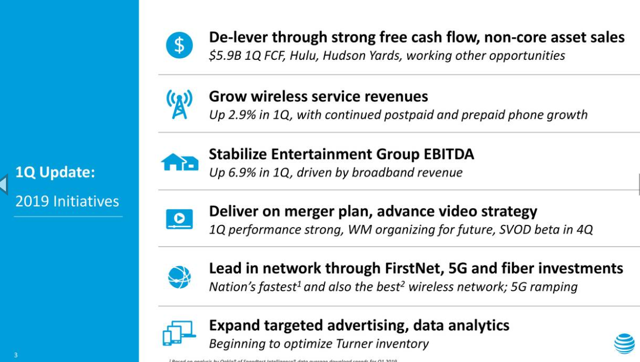

AT&T’s recent earnings release has added more drama for investors with the stock price erasing more than a third of its YTD gains and investor sentiment solely focusing on net subscriber losses and largely underestimating how AT&T is delivering against its 2019 core initiatives.

Source: AT&T Earnings Call Slides Q1 2019

Naturally, seeing the stock price crater almost 5% following its earnings release is not what investors would like to see; however, for long-term investors, this is another great opportunity to buy shares at a 6.6% yield. The dividend is safely covered with FCF expected to increase even more. Net subscriber losses in the premium TV segment, which are shaping the headlines, do not come unexpected, but stronger-than-expected growth in Broadband is helping to stabilize and potentially even grow revenue in the crucial Entertainment Group.

Deleveraging is moving according to plan and driven by strong FCF and the divestment of non-core assets such as the exclusive Hudson Yard space in a deal valued at $2.2B.

So far none of that is reigniting optimism among investors. As such, the drama continues, but only as far as the stock price is concerned and not in terms of the state of AT&T’s business. Long-term investors focusing on income will be rewarded, and with the company paying out its next dividend on May 1, 2019, another attractive DRIP opportunity is just around the corner. On top of that, despite all the negative news surrounding the stock, it is always important to remember that an investor has not lost a penny unless he sold his shares.

If you enjoyed this article, the only favor I ask for is to click the “Follow” button next to my name at the top of this article. This allows me to develop my readership so that I can offer my opinion and experiences to interested readers who may not have received them otherwise. Happy investing.

Disclosure: I am/we are long T, DIS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not offering financial advice but only my personal opinion. Investors may take further aspects and their own due diligence into consideration before making a decision.

The post AT&T: The Market Is Wrong – Seeking Alpha appeared first on Investalist.

from Investalist http://bit.ly/2XL3I2U

0 Comments