Investment Thesis

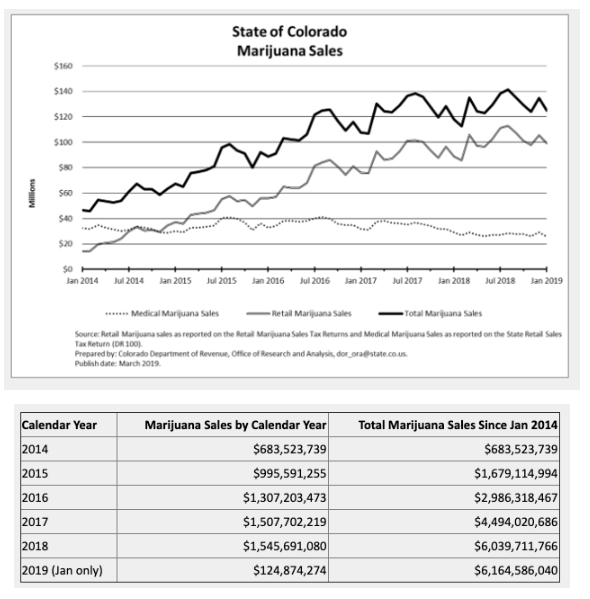

A few weeks ago, I published a DCF analysis on Canopy Growth Corporation (CGC) called Is Canopy Stock Blowing Bubbles And Smoke? where I made key arguments about CGC’s top line, that CGC will obtain the bulk of its revenue from the recreational side of its business, which will likely be constrained to the Canadian market due to the unlikelihood that international regulations will be relaxed to allow for sales in international markets anytime soon. I also forecasted the value of the Canadian recreational market based on the growth rates of the Colorado post legalization. The growth rates were 90% 50%, 30%, 20%, 10%, 10%, 10%, and 1% in perpetuity.

Source: Colorado Department of Revenue

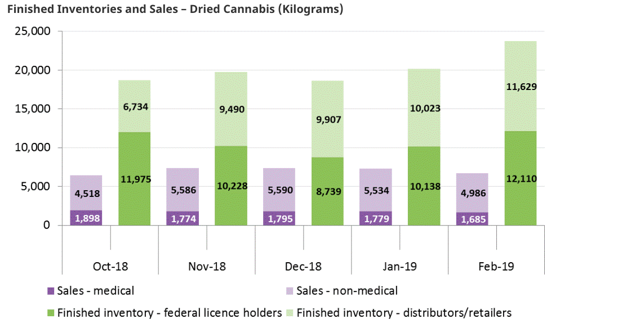

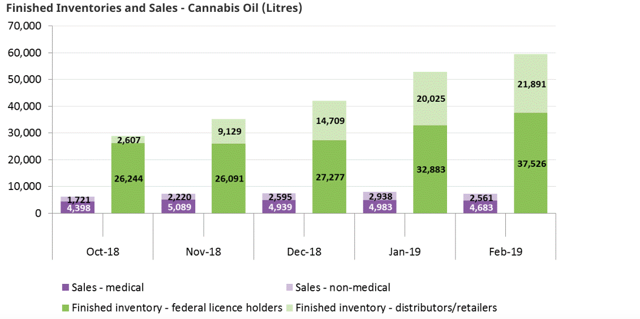

Where this approach may be flawed is, the lack of development in the Canadian recreational cannabis market leads to a very low starting pointing point for this analysis. Consider that Statistics Canada estimated total sales of only $115 Million in Q4 2018, granted this was not a full quarter as legalization happened October 17th, 2019. 5 months of available data show that about 27.7 thousand kilograms have been sold as dried flowers or oils (assuming 1 gram/8 ml oil) and at $8/gram would indicate ~$221.6 Million in sales, which, annualized, is about ~$379 Million. Using this as a starting point and using the annual growth rates from the Colorado case would yield a market value of only ~$1.9 Billion for 2025, which, as discussed in Is Canopy Stock Blowing Bubbles And Smoke?, would not support the CGC’s $20 Billion market capitalization. The reason for the low sales out of the gate is primarily the product shortfall from licensed producers and the kinds of products that are legal to consumer (flower and oils), which are not nearly enough to lure consumers away from the black market.

Source: Health Canada

Source: Health Canada

The purpose of this article is to discuss market forecasts posited by Deloitte, Brightfield Group, BDS Analytics, and CIBC, and New Frontier Data.

Industry Forecasts

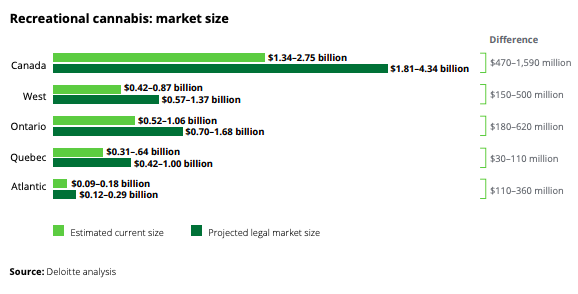

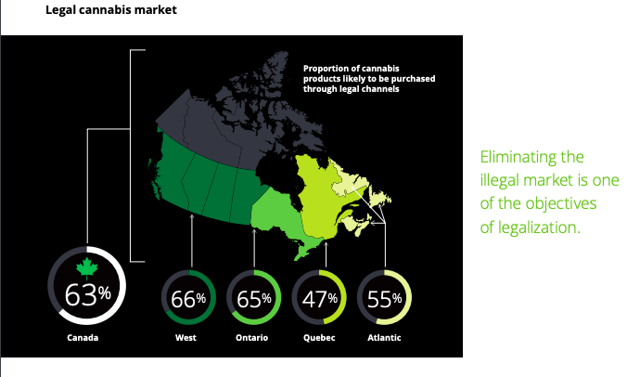

Deloitte, Brightfield Group, BDS Analytics, CIBC, and New Frontier Data are all well regarded for their market insights. Deloitte believes the size of the cannabis market in Canada – including medical, illegal, and legal recreational products – is about $7.17 Billion in sales. $0.77 Million of this is in medical sales. The rest which is obviously the recreational side and well over the majority of which (over 90%) is currently serviced by the black market. However, they believe a flip in the script for end of 2020 of up to $4.34 Billion (68%) of sales will come from the legal recreational market.

Source: Deloitte Analytics

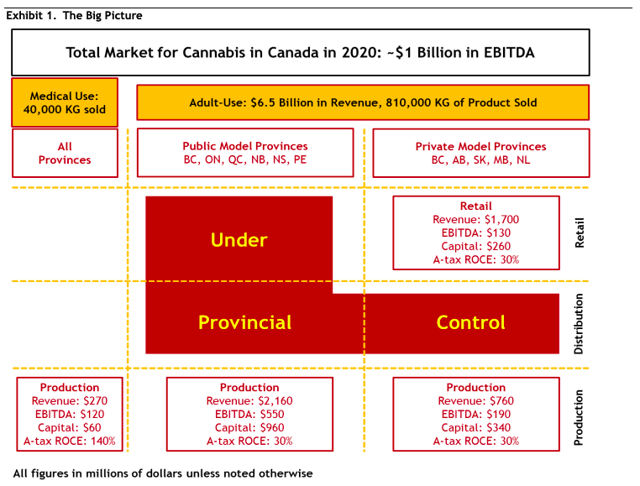

CIBC forecasts the Canadian recreational market at $6.5 Billion for 2020, 810 kg sold (indicating $8/per gram), and $1 Billion in EBITDA from the private sector, with production accounting for over 85% of these amounts, and the remainder coming from retail – largely in western Canada.

Source: Cannabis Almost Showtime

In summary, here are the results of the different studies. We show the forecasted market value of the Canadian recreational cannabis market by the different organizational studies, the implied number of kilograms sold, assuming an $8/gram average sale price, the year that the market value forecasted is realized before the market goes into steady state growth, and the implied annualized growth rate to reach the market value posited from the current level of ~$379 Million in annual sales.

| Organization | Forecasted Market Value (billions) | Kilograms sold at $8/gram (thousands) | Year | Implied Annual Growth Rate |

| Deloitte | $4.34 | 543 | 2020 | 1,045% |

| CIBC | $6.50 | 810 | 2020 | 1,615% |

| New Frontier Group | $9.20 | 1150 | 2025 | 70% |

| BDS Analytics | $4.80 | 600 | 2024 | 66% |

| Brightfield Group | $5.00 | 625 | 2021 | 263% |

| Current Market Value | $0.38 | 47 | 2019 |

New Frontier Group is by far the most optimistic, predicting $9.2 Billion by 2025. However, its annualized growth rate is among the lowest. CIBC and Deloitte make arguably the most bold forecasts at $4.34 Billion and $6.5 Billion, which would require annualized growth rates of 1,045% and 1,615%, respectively, over the next year. BDS Analytics is the most conservative, forecasting only $4.8 Million for 2024, and would only require a 66% CAGR.

We will explore all of these different scenarios and their impacts on CGC’s valuation

Assumptions

Other than the revenue forecasts, we use the exact same assumptions in the article Is Canopy Stock Blowing Bubbles And Smoke?. Below is a recap of the different assumptions used in the model:

Revenue

- Kg sold in Canada will increase at the rates implied by the aforementioned studies.

- CGC will service 50% of the Canadian recreational cannabis market.

- Given that it is highly unlikely that Canadian producers will be able to fully access the recreational markets of the U.S. or Europe in the near future due to strict regulations in both countries, two of the largest markets, we will assume that CGC only services the Canadian recreational market but will have access to the medical market globally.

- Similar growth parameters for the medical market as the Colorado case, 13%, 7%, then 1% in perpetuity.

- Medical cannabis and recreational cannabis sell for averages of $9.03/g and $6.96/g. It may not be reasonable to assume that these prices can be maintained as more competition enters the space and as recreational cannabis becomes a substitute for medical cannabis, due to being cheaper.

- Other revenue will be 9% of total net revenue.

Cost of Goods Sold

- We use a cost of $2.78/gram to estimate gross margins before adjustments to fair value and assume a 5% decline rate over the next 5 years as this will be essential to be successful with their business model as they are largely a “price taking firm.” The cost will stay level after 5 years into perpetuity.

- We ignore the effects of unrealized gains on changes in fair value of biological assets.

SG&A

- We make the assumption that it will be in line with the previous year at 50% of revenue for 2020, then will steadily decline to 33%, 10%, then 5% in perpetuity.

R&D

- R&D expenses will be set to 2% of sales.

General and Administrative

- We assume that G&A expenses will be 50% of revenue for 2020, then decline to 10% of revenue into perpetuity.

Acquisition Expenses

- We assume 7%, 5%, then 1% of revenue into perpetuity.

Net Working Capital

- We assume net working capital grows at one quarter the rate of revenue (as there is usually 4 harvests per year). We subtract cash from this estimate as most cash on the balance sheet is earmarked for acquisitions.

CAPEX

- Given that CGC has already spent $3.4 Billion of their $5 Billion cash injection from Constellation Brands (STZ) on their acquisition of Acreage in an attempt to gain access into the U.S. cannabis market, it would not be far-fetched to believe that the remaining $1.6 Billion is spent before the end of 2019 on acquisitions. CAPEX will be equal to depreciation (10% of revenues) into perpetuity.

WACC

We do valuations using a range of WACCs between 7.0% and 8.5%, which is reasonable as their capital structure is mostly equity (D/E of only 16%).

Terminal Free Cash Flow Growth

We assume 1-2% revenue growth in perpetuity (about in line with alcohol sales in Canada and the U.S.), which translates into about 2-4% free cash flow growth in perpetuity. We provide valuation range estimates similar to the WACCs.

Valuation Analysis

Below, we can see the valuation ranges when the various studies are incorporated into our CGC valuation model.

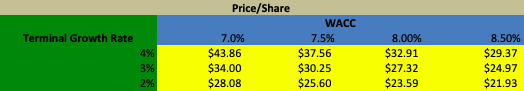

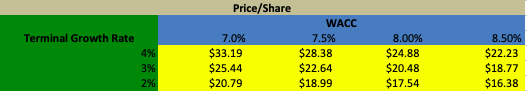

BDS Analytics

Source: Author Tables

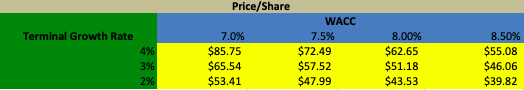

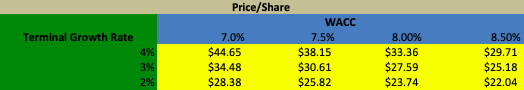

New Frontier Group

Source: Author Tables

CIBC

Source: Author Tables

Deloitte

Source: Author Tables

Brightfield Group

Source: Author Tables

As we can see below, the model is very sensitive to the WACCs and the terminal free cash flow growth rates as the valuation ranges vary by $20/share from the most conservative assumptions at an 8.5% WACC and 2% free cash flow growth rate to the most aggressive at a 7% WACC to a 4% free cash flow growth rate. The valuation range is $45/share in the case of New Frontier.

Conclusion

Granted, the model is very sensitive to the assumptions like many financial models are, what can be gleaned from this insight is that even if the Canadian recreational cannabis market grows to $4.34-6.5 Billion before 2025, this will not be enough to support CGC’s current $20 Billion market capitalization. The Canadian market would have to grow to north of $9.0 Billion a year before 2025 just for CGC to potentially be fairly valued. That would mean the market would have to grow at a CAGR of at least 70% per year from the current annualized market value of ~$379 Million, which is well above the growth rates observed in Colorado since 2012 when recreational use was legalized. We must keep in mind as well that Colorado’s market participants were mainly small private enterprises, and not large crown corporations like in Canada. The small, nimble dispensaries in Colorado could increase purchase orders rapidly and fill the growing demand. In Canada, provincial entities will not have the same flexibility to increase their purchases as efficiently as their neighbors to the south.

The only way the $60/share is justified is if globally we started to see more countries legalize recreational cannabis, which is highly likely, but obtaining full access to those markets seems highly unlikely in the near future, given current regulations in most countries, especially the U.S.

Disclosure: I am/we are short CGC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The post Canopy Growth Corporation: A DCF Based On Industry Growth Projections – Seeking Alpha appeared first on Investalist.

from Investalist http://bit.ly/2GSspVn

0 comments:

Post a Comment